FedEx and UPS raise fuel surcharge yet again - How does this affect returns?

Leading carriers FedEx and UPS have raised their fuel surcharges again, impacting shipping costs. Discover how these changes affect shippers and the wider logistics sector in our latest analysis

After their previous hike in December 2023, leading transportation carriers UPS and FedEx have once more raised their fuel surcharges for deliveries. What does this mean for shippers? Let’s dive in.

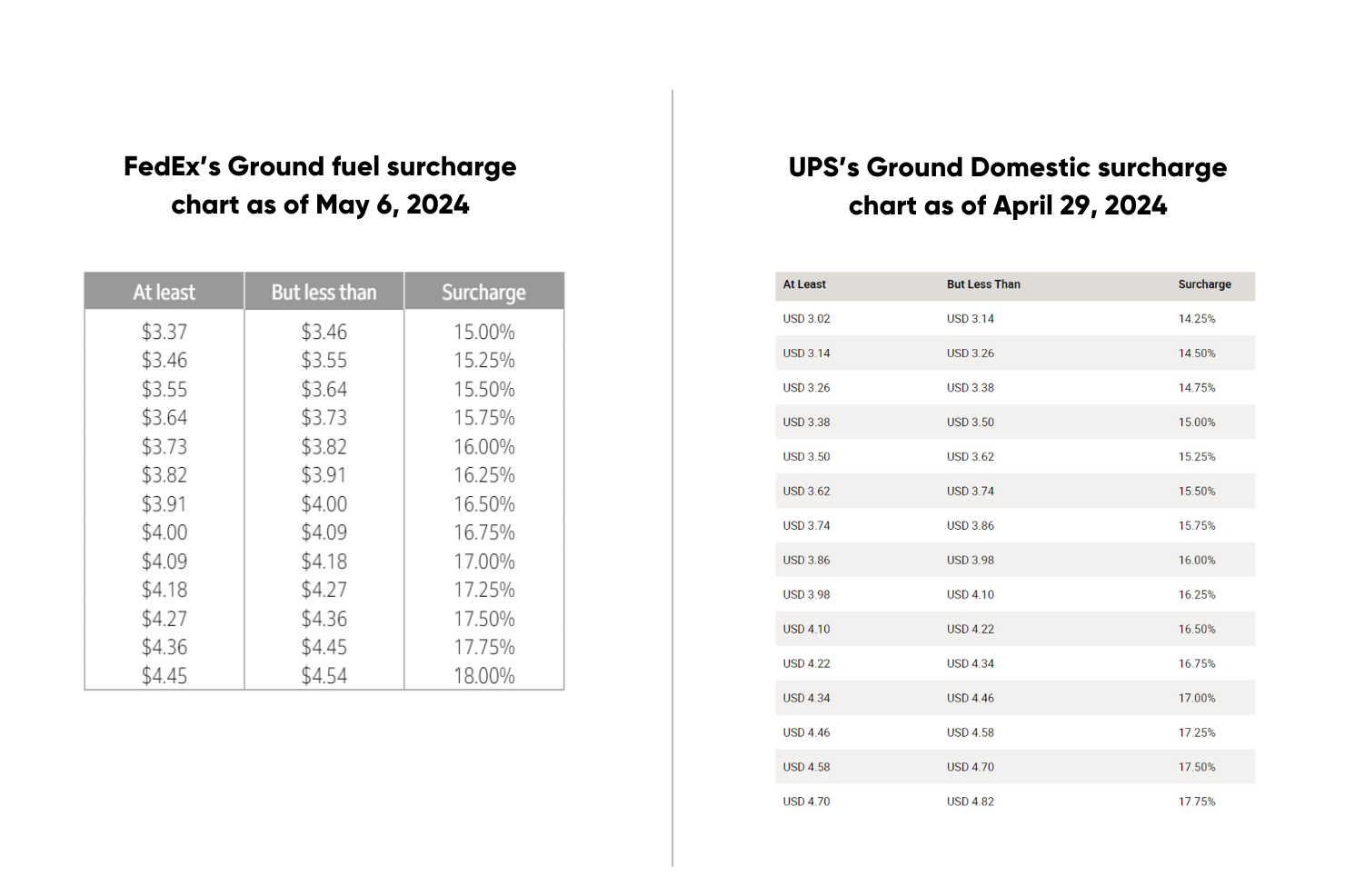

When consumers and businesses go to send packages, they encounter a fuel surcharge added into their total. This surcharge rate fluctuates weekly, determined by the price of USGC fuel for air shipments and the average price of U.S. On-Highway Diesel Fuel for ground shipments. Essentially, the higher the fuel price, the higher the percentage consumers pay in surcharges. The carriers will be raising the percentages of the fuel price paid by customers across the board.

So how much of a raise are we looking at?

UPS rates will see an increase of 50 basis points for air, UPS domestic ground and UPS SurePost. So what once would have been a 15% payment per gallon of fuel by consumers will now be 15.5%. FedEx is raising their fee by 100 basis points for both air and ground transport.

Why the increase?

As fuel prices have remained consistently lower, FedEx and UPS have seen customers paying in the lower percentages of the fuel surcharges. These decreases in charges have posed a challenge for both companies, affecting their financial performance in the most recently reported quarters. Raising this fee is a move by the companies to raise their per-package profit and see an overall increase in revenue for Q2.

This price increase comes after a series of discounts offered to consumers, by both parties, as part of the carrier's efforts to attract customers during a period of decreased demand for package shipment. We now see a raise in the price per package, with no discounts offered by the carriers. The ground rate per package in Q2 is forecasted at 29.3% above the index’s January 2018 baseline. The new cost is the second highest seen by consumers since Q1 2023 that had a rate of 31.4%.

The impact of returns

As e-commerce shopping rates continue to climb, returns have also been making their mark in the logistics industry.

During the UPS Q1 2024 earnings call, CEO Carol Tome endorsed the profitability that comes with the return industry, “Returns are attractive to us for a couple of reasons. First, they are typically B2B movements, and as a result, drive pickup and delivery density. Second, our frictionless offering creates customer loyalty and repeat business.” Tome also mentioned UPS’s HappyReturns service profitability, “During the first quarter, our overall returns volume in the U.S. increased 1.4%, and Happy Returns more than quadrupled its ADV in the first quarter.”

The e-commerce sector sees an average return rate from 20% to 30%, amounting to $743 billion in returns in 2023. This presents a significant revenue opportunity for logistic companies to leverage.

What is the effect on customer satisfaction?

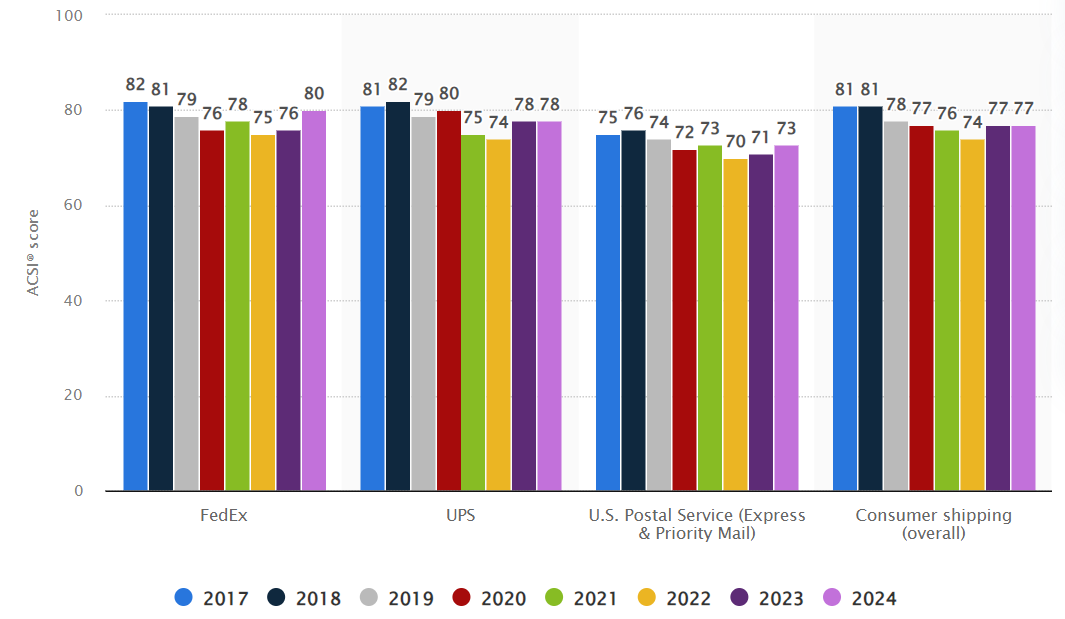

The industry giants have experienced a general decline in customer satisfaction over the past few years, according to Statista. However, FedEx has witnessed a notable increase in satisfaction levels so far this year.

In conclusion

This situation presents a crucial test for both FedEx and UPS, as they gauge how their clientele will react to the heightened surcharges. If shippers prove reluctant to absorb the added cost without the buffer of discounts, it could prompt further adjustments in pricing strategies or incentives from the carriers. Ultimately, the market's response will shape the broader dynamics of package shipment in the coming quarters.